per capita tax reading pa

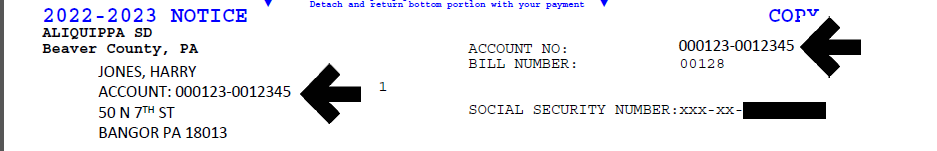

DISCOUNT AUGUST 31 FACE OCTOBER 31 PENALTY NOVEMBER 1. The following information is necessary for our records and will be held in strict confidence.

Steelton Borough Steelton-Highspire School District Paint Borough Delinquent Per Capita only Scalp Level Borough Delinquent Per Capita only Windber Borough delinquent Per Capita only and Shanksville-Stonycreek School District.

. 2014 to Present 3000YR. Tax Collector Kristi Piersol is the Townships elected Tax Collector and is responsible for collecting Real Estate Taxes and Per Capita Taxes. Fiscal year starts March 1.

Check your current bill for more information. Ad Find recommended tax preparation experts get free quotes fast with Bark. West Reading Borough has not collected a.

The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction. Exonerations from the. This tax is due yearly and is based solely on residency it is NOT dependent upon employment or property ownership.

Kenhorst Borough - 500. When is it levied. The Tax Collectors office is located at the Boroughs Municipal Building 999 E.

Per Capita Tax We collect for. 1000 Reading School District 724978-2866 Spanish 888328 0561. KEYSTONE COLLECTIONS GROUP PO BOX 489 IRWIN PA 15642 724978-2866 Spanish 888328 0561 CITY OF READING - 2016 PRIOR YEARS.

IRWIN PA 15642. This tax is due yearly and is based solely on residency it is NOT dependent upon employment or property ownership. Per Capita means by head so this tax is commonly called a head tax.

Occupational Assessment Taxes are assessed on all employed residents that hold. Citizens Service Center. 10 Fairlane Road PO Box 4216 Reading PA 19606.

In other words if you. COLLECTION HOURS - 2018. Keystone is New Per Capita Tax Collector in Reading.

Per Capita means by head so this tax is commonly called a head tax. The application form may be used by a PA taxpayer whose community has adopted one or more tax exemptions. Why do I have to pay a per capita tax.

This tax is due yearly and is based solely on residency it is NOT dependent upon employment or property ownership. How many Per Capita taxes do I have to pay. Can I apply for exoneration from this tax.

Local Services Tax - 5200 annually payable to Berks County Earned Income Tax Bureau Berks EIT. Sales Use and Hotel Occupancy Tax. Current Governor Mifflin School Real Estate Tax - The current Governor Mifflin School District Real Estate Tax rate is 245 Mills.

KEYSTONE COLLECTIONS GROUP. Start wNo Money Down 100 Back Guarantee. Per Capita Tax.

Municipalities and school districts were given the right to collect a 1000 per capita tax under ACT 511 and School Districts an additional 500 under ACT 679 School Tax Code. Motor and Alternative Fuel Taxes. 815 Washington Street.

If you pay your bill on or before the discount date in September you receive a 3 discount. ACT 679 Tax is a 500 Per Capita Tax authorized under the PA School Code and is addition to the 1000 Per Capita that can be. Ad Compare Your 2022 Tax Bracket vs.

Berks County Municipalities Borough of Kenhorst. Discover Helpful Information and Resources on Taxes From AARP. Office hours vary and can be found on the tax bills.

Harris Agency for collection. What is per capita tax. For most areas adult is defined as 18 years of age and older though in some areas the minimum age may differ.

Depending on the district you live in the County TownshipMunicipality and School District can each enact a Per Capita tax. Office hours vary and can be found on the tax bills. Your 2021 Tax Bracket to See Whats Been Adjusted.

City of Reading. Is this tax withheld by my employer. City of Reading.

2016 PRIOR YEARS - CITY OF READING. Receive Fast Free Tax Preparation Quotes From The Best Tax Accountants Near You. What is the Per Capita tax.

Current Per Capita Taxes. PO BOX 489. Prior to 2014 1500YR 2014 to Present 3000YR 2000 City of Reading 1000 Reading School District.

Residents of Lower Alsace Township or Mount Penn Borough 18 years of age and older regardless of work status. Per Capita Tax is a tax levied by a taxing authority to everyone over 17 years of age residing in their jurisdiction. Reading PA 19601-3690.

10 Fairlane Road PO Box 4216 Reading PA 19606 Ph. Prior to 2014 1500YR. For most areas adult is defined as 18 years of age and older though in some areas the minimum age may differ.

There is a 2 discount available for payments made in March andor April of the current tax year. 1000 annually per individual. The Government Website Experts.

Reading PA 19606 610 779-5660 Login Powered by revize. Mifflin School District Per Capita Tax - 1470 for every person over 18 years of age who resides within the school district. Governor Mifflin School District - 1000.

Exoneration from tax is applicable to the current tax year only. Ad Honest Fast Help - A BBB Rated. The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction.

Reminder to pay your Per Capita tax bill before December 31st. Should you have any questions please call Carol Leiphart at 6106851763. You must file exemption application each year you receive a tax bill.

The Per Capita Tax Exemption Form should be used for areas not listed below. Unpaid Per Capita taxes are turned over to the G. Diamond is the Townships elected Tax Collector and is responsible for collecting Real Estate Taxes and Per Capita Taxes.

2000 City of Reading Share. Normally the Per Capita tax is NOT withheld by your employer.

State Local Property Tax Collections Per Capita Tax Foundation

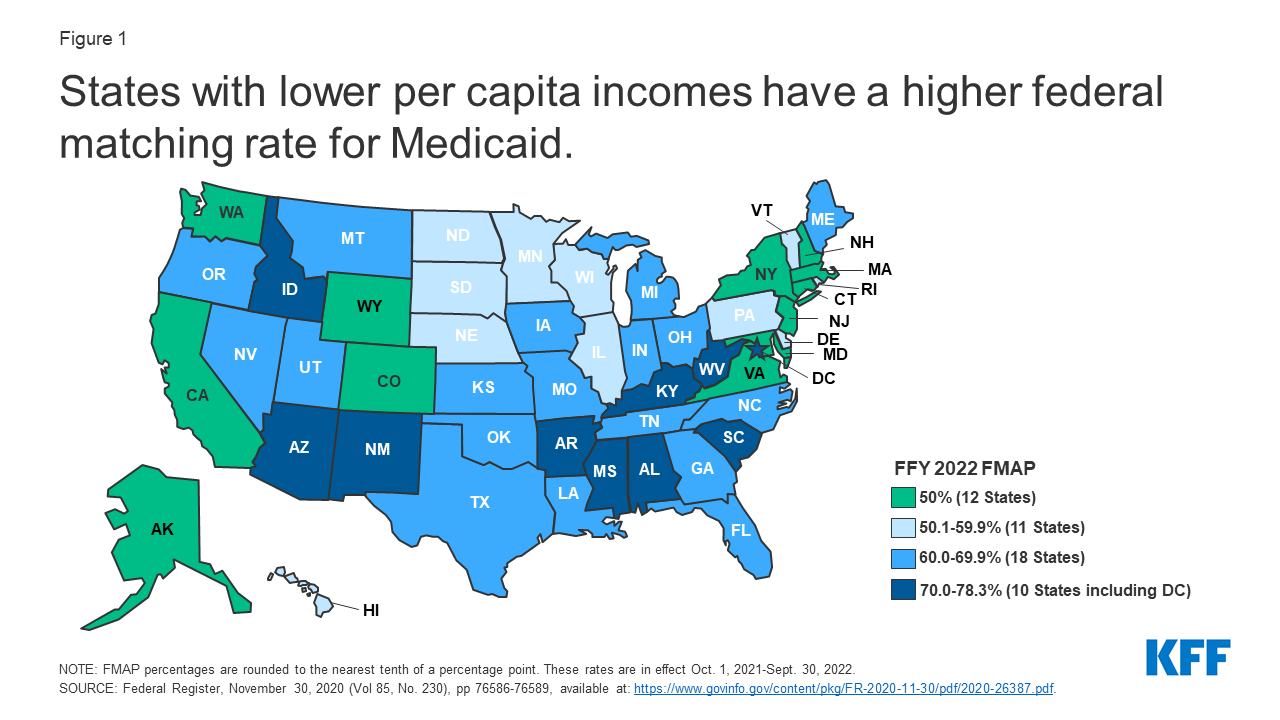

Medicaid Financing The Basics Issue Brief 8953 03 Kff

Real Estate And Per Capita Tax Wilson School District Berks County Pa

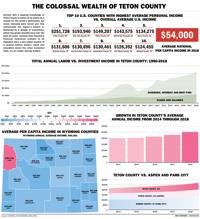

Teton Leads Nation In Per Capita Income Town County Jhnewsandguide Com

Per Capita Tax Exemption Form Keystone Collections Group

Per Capita Tax Exemption Form Keystone Collections Group

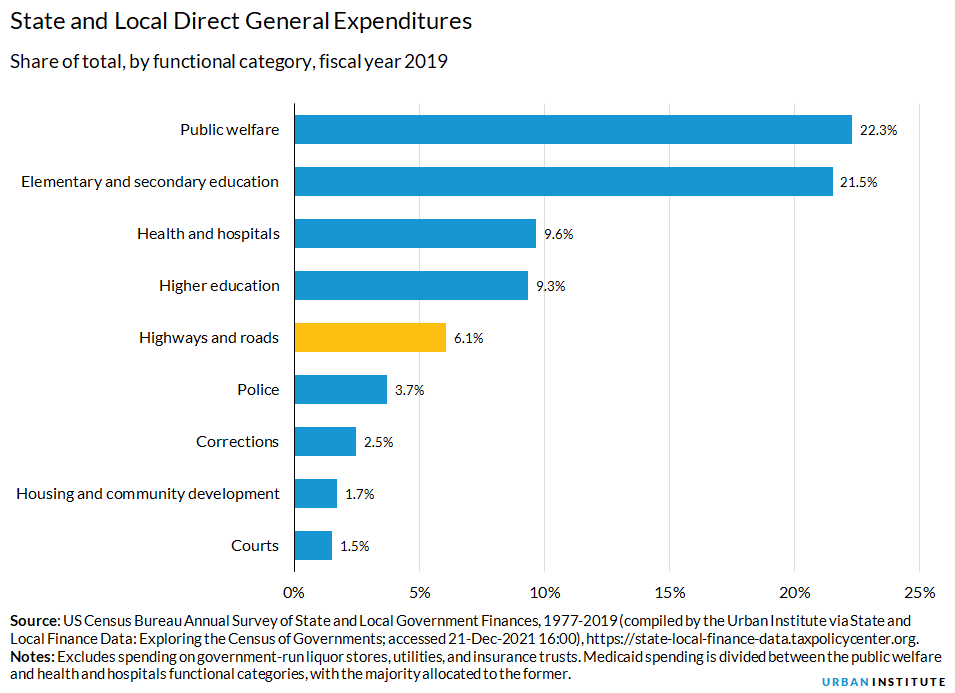

Highway And Road Expenditures Urban Institute